Last Updated on: 26th December 2025, 11:22 am

Understanding how much money actually reaches your bank account each month is becoming increasingly important in the UK, especially as living costs remain high and tax thresholds continue to affect earnings.

While job offers and contracts usually highlight gross salary figures, the reality of take-home pay is shaped by a combination of income tax, National Insurance contributions, and other deductions.

Knowing how these elements work together can help individuals plan finances more realistically and avoid unpleasant surprises on payday.

This guide explains how the UK tax system impacts real earnings, why take-home pay often feels lower than expected, and how different employment situations change the final amount received.

Why Gross Salary Rarely Matches Take-Home Pay?

Gross salary is the amount agreed with an employer before any deductions are applied. However, this figure does not reflect the money available for everyday spending. Once income tax and National Insurance are deducted, the final net pay can be significantly lower.

The gap between gross and net income is especially noticeable as earnings move into higher tax bands. Many workers only realise the true impact of deductions after receiving their first payslip, which highlights how different thresholds apply to portions of income rather than the full amount.

How UK Income Tax Affects Earnings?

Income tax in the UK operates on a banded system. Rather than taxing all income at a single rate, earnings are split into portions, each taxed at a different level.

The personal allowance allows individuals to earn a certain amount tax-free. Once income exceeds this threshold, tax is applied incrementally. As earnings rise into higher bands, a larger portion of income is taxed at increased rates, reducing the proportion of salary that reaches the individual.

For many employees, this structure explains why pay rises do not always feel as substantial as expected. While the gross figure increases, additional income may fall into higher tax brackets, limiting the net gain.

The Role of National Insurance Contributions

National Insurance contributions (NICs) are often overlooked when considering take-home pay, yet they play a major role in reducing net income. Unlike income tax, National Insurance is calculated per pay period rather than annually, which means deductions can fluctuate month to month.

Employees typically pay Class 1 National Insurance, with rates applied once earnings exceed a set threshold. Employers also contribute separately, although this does not appear on employee payslips. For higher earners, National Insurance continues to reduce take-home pay even when income tax bands change.

For self-employed individuals, National Insurance works differently, with Class 2 and Class 4 contributions calculated through self-assessment. This difference can significantly alter take-home figures when compared to salaried employees on similar gross incomes.

Take-Home Pay for Different Types of Workers

Take-home pay varies depending on how income is earned. Employees, contractors, freelancers, and business owners all experience deductions differently.

Employees typically see income tax and National Insurance deducted automatically through PAYE. Contractors working through limited companies may pay themselves via a combination of salary and dividends, which changes how tax applies.

Freelancers and sole traders calculate deductions annually, often setting money aside throughout the year to cover tax bills. These differences mean that two individuals earning the same gross amount can take home very different sums depending on their working arrangement.

Business Implications of Take-Home Pay Changes

Changes in take-home pay do not only affect individuals. Employers must also consider how tax and National Insurance influence recruitment, retention, and wage expectations. Rising deductions can lead employees to request higher gross salaries to maintain the same standard of living, increasing payroll pressures for businesses.

Beyond individual payslips, shifts in income tax and National Insurance often influence broader business decisions such as salary benchmarking, contractor rates, and workforce planning.

Many organisations keep a close eye on these developments to remain competitive while managing costs effectively, a subject frequently covered by UK Business Times, where the wider business impact of financial and tax changes is analysed in detail.

Why Take-Home Pay Feels Lower During Pay Rises?

One common frustration for workers is receiving a pay rise that feels underwhelming. This often happens because additional earnings fall into higher tax or National Insurance thresholds. While the headline salary increase looks positive, the net benefit may be modest.

This effect is particularly noticeable for those approaching higher-rate tax bands or losing part of their personal allowance due to increased income. Understanding this mechanism helps set realistic expectations and encourages better financial planning.

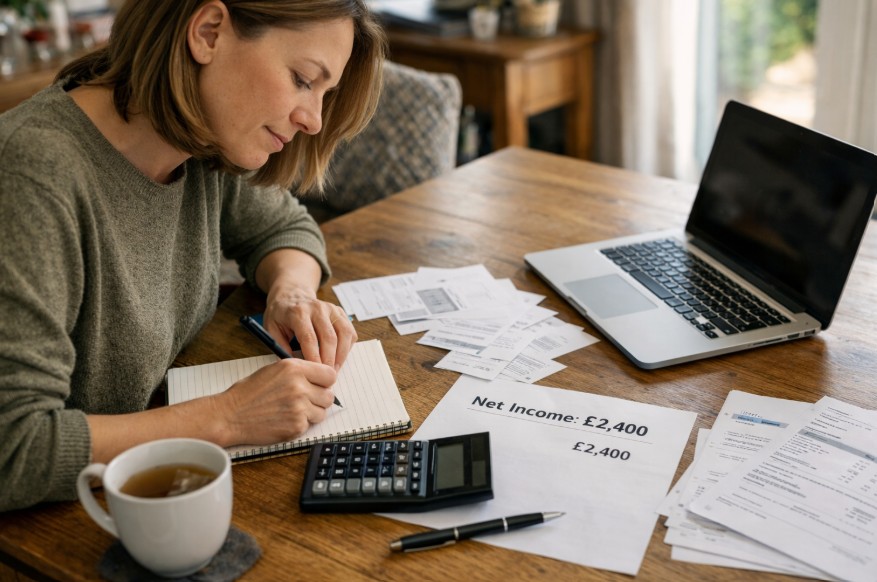

Planning Around Net Income, Not Gross Figures

Focusing on net income rather than gross salary allows for more accurate budgeting. Monthly expenses such as rent, mortgages, utilities, and savings are paid using take-home pay, not headline earnings.

By estimating net income in advance, individuals can:

- Plan savings more effectively

- Avoid overspending based on inflated expectations

- Make informed decisions about overtime, bonuses, or job changes

This approach is especially valuable for freelancers and contractors, who must account for tax obligations themselves rather than relying on automatic deductions.

The Value of Understanding Your Payslip

Payslips provide a detailed breakdown of how income is calculated and deducted. Reviewing them regularly helps individuals spot errors, understand tax code changes, and track how deductions evolve over time.

Misunderstandings around tax codes or National Insurance thresholds can lead to incorrect deductions, which may only be corrected later through refunds or additional payments. Staying informed reduces the likelihood of these issues and improves overall financial confidence.

Conclusion

Take-home pay is shaped by more than just salary negotiations. Income tax, National Insurance, and employment structure all play crucial roles in determining how much money is actually received. While gross figures may look impressive on paper, understanding deductions provides a clearer picture of real earnings.

By focusing on net income, staying aware of tax thresholds, and recognising how broader economic changes affect wages, individuals and businesses alike can make more informed financial decisions and plan more effectively for the future.

No Comments

Leave a comment Cancel